LCH.Clearnet Accepts ‘Loco London’ Gold As Collateral Next Tuesday

Submitted by Tyler Durden on 08/22/2012 08:09 -0400- Barrick Gold

- Borrowing Costs

- British Pound

- CDS

- Central Banks

- Citigroup

- Copper

- Crude

- Crude Oil

- Deutsche Bank

- European Central Bank

- Eurozone

- Hong Kong

- Hyperinflation

- Japan

- Lehman

- Lehman Brothers

- Middle East

- Moving Averages

- OTC

- Reuters

- Shadow Banking

- Sovereign Risk

- Sovereign Risk

- Vikram Pandit

- Wall Street Journal

- World Gold Council

From GoldCore

LCH.Clearnet Accepts ‘Loco London’ Gold As Collateral Next Tuesday

Today's AM fix was USD 1,640.50, EUR 1,315.87, and GBP 1,038.49 per ounce.

Yesterday’s AM fix was USD 1,624.00, EUR 1,308.94and GBP 1,030.26 per ounce.

Silver is trading at $29.44/oz, €23.74/oz and £18.72/oz. Platinum is trading at $1,524.75/oz, palladium at $628.60/oz and rhodium at $1,025/oz.

Gold climbed $16.60 or 1.02% in New York yesterday and closed at $1,637.60. Silver surged to hit a high of $29.501 and finished with a gain of 1.6%.

Gold in USD – 50, 100, 200 Day Moving Average (Bloomberg)

Gold briefly popped above the 200 day moving average at $1,643/oz this morning and remains near the 3 ½ month high set in the prior session. A break above the 200 day moving average, after similar breaks of the 50 and 100 day moving averages, will be bullish technically (see chart).

Market watchers are still optimistic that the ECB’s Mario Draghi will bring out the bazooka and unleash more euro paper in the form of the SMP program which would be the icing on the cake for what is an already very bullish gold scenario.

Recent news that the ECB has been creating alternatives to limit Spanish and Italian borrowing costs may have sent gold higher yesterday, increasing its inflation hedge appeal.

Later today the FOMC releases the minutes from its latest meeting and investors will search for clues on when QE3 will occur.

Gold’s remonetisation in the international financial and monetary system continues.

LCH.Clearnet, the world's leading independent clearing house, said yesterday that it will accept gold as collateral for margin cover purposes starting in just one week - next Tuesday August 28th.

LCH.Clearnet is a clearing house for major international exchanges and platforms, as well as a range of OTC markets. As recently as 9 months ago, figures showed that they clear approximately 50% of the $348 trillion global interest rate swap market and are the second largest clearer of bonds and repos in the world. In addition, they clear a broad range of asset classes including commodities, securities, exchange traded derivatives, CDS, energy and freight.

The development follows the same significant policy change from CME Clearing Europe, the London-based clearinghouse of CME Group Inc. (CME), announced last Friday that it planned to accept gold bullion as collateral for margin requirements on over-the-counter commodities derivatives.

It is interesting that both CME and now LCH.Clearnet Group have both decided to allow use of gold as collateral next Tuesday - August 28th. It suggests that there were high level discussions between the world’s leading clearing houses and they both decided to enact the measures next Tuesday.

It is likely that they are concerned about ‘event’ risk, systemic and monetary risk and about a Lehman Brothers style crisis enveloping the massive, opaque and unregulated shadow banking system.

Overnight, Citigroup CEO Vikram Pandit warned in Singapore that risks are set to increase as non-bank financial systems expand, adding that it’s impossible for a regulatory body to “see everything.”

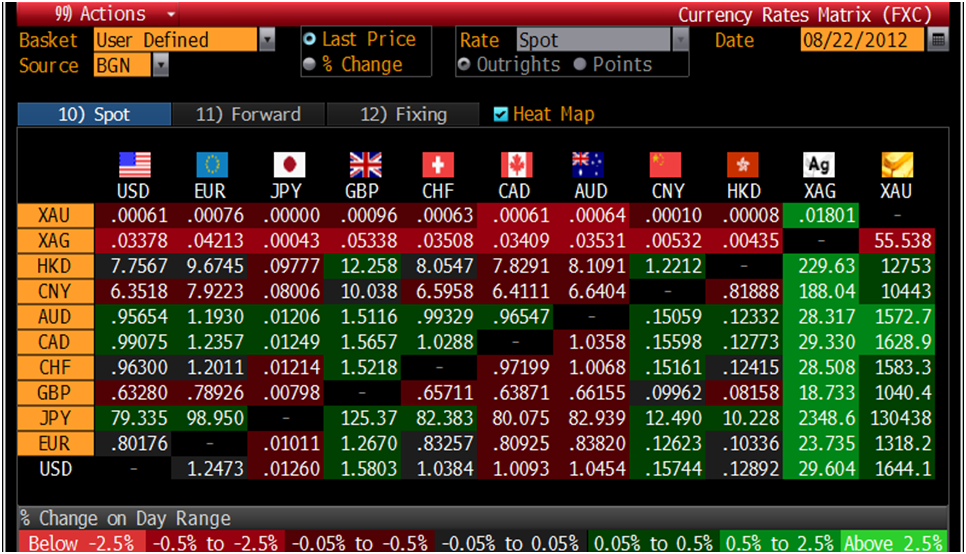

Cross Currency Table – (Bloomberg)

LCH.Clearnet Group Ltd. said it will accept loco London gold as collateral for margin-cover requirements on OTC precious-metals forward contracts and on Hong Kong Mercantile Exchange precious-metals contracts starting Aug. 28. Loco London gold are London Good Delivery Bars (roughly 400-ounce or 12.5 kilograms gold bar) held with LBMA members within the London bullion clearing system.

The clearing house has already been using gold bullion as collateral since 2011 but now will accept loco London gold as collateral.

The push to use gold as collateral follows similar steps from a growing number of exchanges and banks to increase the use of gold as an acceptable deposit and collateral reinforcing gold's renewed status as a safe haven currency.

Intercontinental Exchange Inc. (ICE) also has allowed the use of gold as collateral.

LCH.Clearnet limited the amount of gold that could be used as collateral to no more than 40% of the total margin cover requirement for a member across all products and at a maximum of $200 million, or roughly 130,000 troy ounces, per member group.

The move follows the initiative of the World Gold Council, who last year submitted evidence to the Basel Committee for gold to be included in banks’ ‘Tier 1’ assets by European banking regulators, recognising gold’s growing relevance as a high quality liquid asset.

David Farrar, Director, LCH.Clearnet said at the time that “market participants want greater choice when it comes to assets that can be used as collateral. Gold is ideal; as an asset it typically performs well in times of financial stress, remains liquid and has a well established pricing mechanism.”

Gold Prices/Fixes/Rates/Vols – (Bloomberg)

We pointed out the importance of this development last year but it was ignored by most of the media and even much of the blogosphere.

The CME and LCH.Clearnet both allowing gold bullion as collateral is extremely bullish for the gold market.

With counterparty and sovereign risk remaining elevated, gold is no longer being seen simply as a commodity. Rather, it is increasingly viewed by market participants as an important asset and a currency with no counterparty risk.

We are gradually seeing the remonetisation and indeed the ’financialisation’ of gold, as gold is gradually being reincorporated into the modern financial and monetary system.

This should result in the coming months and years in markedly higher prices than those of today.

Keynes’s ‘barbaric relic’ is becoming less barbaric by the day. However, the man on the street remains completely unaware of this trend and continues to sell gold (jewellery) rather than buy gold (bullion) as clearly seen in the international phenomenon that is 'cash for gold'.

Huge developments in the gold market such as this continue to be ignored by non specialist financial media and its implications not realized by many so called experts. The "experts" and public consensus is that gold is a risky volatile commodity and may even be a “bubble".”

The truth, which is being seen more clearly by the day, is that gold is actually a finite currency and the safest form of money in the world.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

NEWSWIRE

(Bloomberg) -- CME Clearing Europe to Clear London Silver Forwards from Aug. 28

CME Clearing Europe will start clearing London silver forwards from Aug. 28, it said in an e- mailed statement today.

The product will be physically-settled, it said.

(Bloomberg) -- Lonmin Says Marikana Worker Attendance Falls to 22% From 33%

Lonmin Plc said about 22 percent of the 28,000 workers at its Marikana mine in South Africa reported for duty today compared with 33 percent yesterday.

There probably won’t be any significant production restart this week, Susan Vey, a spokeswoman for the company said by phone from the mine today. The mine will be shut for a memorial service tomorrow, she said. “We’re hoping for a complete change” on Aug. 27, she said.

(Bloomberg) -- Peru’s June Gold Output Fell 5.9% to 13,094 Kg, Ministry Says

Peru’s gold production fell 5.9 percent to 13,094 kilograms in June from a year earlier on declines at Cia. de Minas Buenaventura’s La Zanja mine and Barrick Gold Corp’s Misquichilca mine.

(Bloomberg) – Platinum May Rise With Gold For Six Months

Platinum may rise with gold over the next two quarters, Daniel Brebner, an analyst at Deutsche Bank AG said.

Copper “continues to have problems on the supply side,” Brebner said. Copper is probably going to a have a shortage this year, not a surplus as expected earlier in the year, he said.

(Bloomberg) -- Pandit Says Shadow Banking Is a Major Concern

Citigroup CEO Vikram Pandit says risks to increase as non-bank financial systems expand, adding that it’s impossible for a regulatory body to “see everything.” He spoke at a speech in Singapore.

? Pandit says investors see opportunity in light regulation in shadow banking

? “Every piece of regulation we are talking about today has but one goal; to enhance the safety and soundness of the financial system. But this goal will not be achieved if all that we accomplish is to impose more requirements on the formal banking sector while leaving the non-bank financial sector relatively untouched.”

(Bloomberg) -- Commodities Enter Bull Market - Gaining 21%

Commodities entered a bull market, gaining 21 percent from a June low, as grain prices surged after the most severe U.S. drought in half a century and as crude oil rallied amid increased tension in the Middle East.

The Standard & Poor’s GSCI Spot Index of 24 raw materials rose 0.9 percent to end at 675.55 yesterday in New York. The gauge has jumped from this year’s lowest close of 559 on June 21. A gain of more than 20 percent is the common definition of a bull market. Crude accounts for more than 50 percent of index.

NEWS

Gold near 3-1/2 month high on ECB hopes - Reuters

Gold To Rally As Central Banks, Investors Buy, Coutts Says - Bloomberg

Shares slip after Japan exports fall, euro steady - Reuters

Gold Flat in Asia; FOMC Minutes in Focus – Wall Street Journal

COMMENTARY

Why a collapse of the Eurozone must be avoided – Hyperinflation - Vox

What 40 Years Of Gold Confiscation By The US Government Looks Like – Zero Hedge

Is Gold Money? LCH Accepts Shiny Yellow Metal As Collateral – Zero Hedge

Suicidal Skullduggery in the City & Unusually Small Heads on the Street – Max Keiser

Keine Kommentare:

Kommentar veröffentlichen